Attention business owners!

Under the Federal Corporate Transparency Act of 2021, many businesses need to take action before January 1, 2025, and file Beneficial Ownership Information (BOI) to the U.S. Treasury Financial Crimes Enforcement Network (FinCEN). This new mandate is part of an initiative to combat financial crime.

Don’t risk non-compliance! If your business does not qualify for one of 23 exemptions, then you must file a report with the federal government. In addition, any changes to beneficial ownership of your business will necessitate filing updates no later than 30 days after such change.

Identifying who is a beneficial owner is critical for this filing. To do this, you need to determine who exercises “substantial control” and who owns at least 25 percent of your company’s interest. If your business was formed after January 1, 2024, additional reporting requirements may apply.

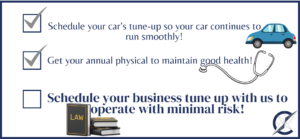

To help you navigate this process, Compass Law Partners is here for you. For the remainder of 2024, we are offering a discounted flat fee of $500 to analyze whether you need to file such a report and to handle the filing on your behalf.

Time is of the essence! Don’t delay—ensure your business is compliant with these new regulations and avoid potential penalties. Contact Compass Law Partners today!